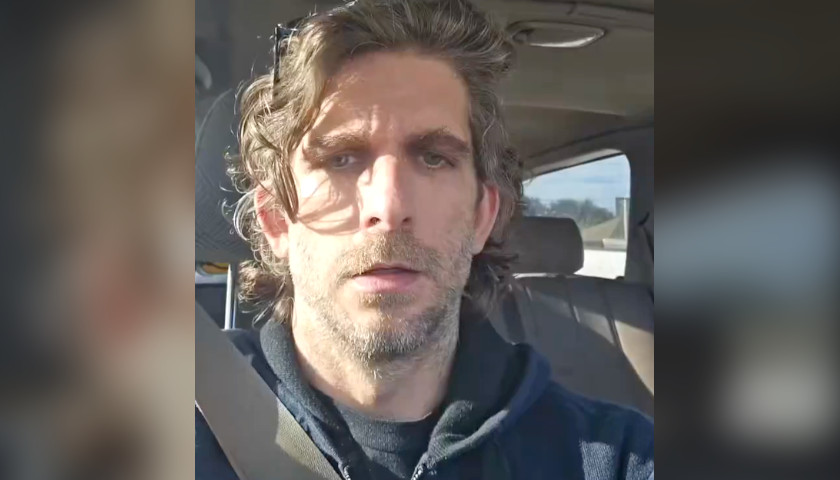

In 2018 a new organization was created in northeastern Ohio – the Tax Working Group. There has been a growing concern about the large increase in property taxes, so following the Liberator Conference last year, several of the citizens formed the new group. Executive Director Thomas Hach explained their issues to The Ohio Star, “While there is no question government has a role, the question is what is the reasonable cost Ohio taxpayers should bear?”

The Tax Working Group (TWG) helps individuals and groups of citizens answer that question. Hach said property taxes are not only expensive, they are complicated, and gave an example: “To highlight how involved things can get regarding property taxes, [we] did research on all of the political subdivisions which have tax jurisdiction over one square foot in downtown Chagrin Falls, Ohio. Based on [that] research, it was found there were over 25 political subdivisions which raised tax money on that one square foot of property.”

Currently, their research is focused on nine counties: Lorain, Medina, Cuyahoga, Lake, Portage, Summit, Ashland, Geauga and Ashtabula. TWG analyzed the counties’ property tax data using information obtained from the county auditors.

“Through this analysis, it was determined property taxes overall in the nine counties went up faster than inflation, while median household income is less today than it was in 2001,” Hach said.

Its website includes educational videos, a glossary of terms and multiple resources like “Levy Facts, Self-Inflicted Eviction.” TWG uses that term “to capture the dynamic between rising property taxes and the negative impact to household budgets. This is because property taxes are the one tax where voters get to voice their opinion to either approve or disapprove.”

“The political subdivision, whether it is a park district, township or school district, can always make an emotional case for increased taxes. However, there is rarely anyone making the case regarding the negative consequences of increased property taxes,” Hach explained. “These negative consequences include people on fixed incomes being forced out of their homes when property taxes make them unaffordable or when young people are forced to rent because property taxes make the home they want to buy too expensive. In essence, this can be looked at as ‘self-inflicted eviction.'”

Hach and the Tax Working Group do not just provide information, they offer their services as well. Their website lists three areas where they can provide help:

- developing data: “The data is analyzed to determine if a County’s Population is incurring Property Tax growth greater than inflation.”

- 1st Aid for Tax Payers: “We help provide FIRST AID level answers to NAGGING QUESTIONS. You will then be able to seek ADVANCED LEVELS of help to assist or enable you to effectively resist Levies that are not reasonable, cause undue hardship on all but especially fixed-income property owners. In the course of this tax relief treatment, we will assist in identifying ‘taxing subdivision’ levies that incur a forever taxation – better known as the CONTINUING LEVY.” [emphasis theirs]

- CIAB – Campaign in a Box: when it’s determined that a levy is not in the best interests of the citizens, TWG helps the locals organize a campaign against it.

Hach shared their victories, “Over the last few election cycles, the Tax Working Group assisted several volunteer groups in the Cleveland-area to defeat a number of unwarranted tax increases.”

For more information, the website is www.taxwg.com.

– – –