Wells Fargo was slapped with a massive government fine in September 2016 after it was found to be pressuring consumers to open accounts they didn’t want and even secretly opening accounts without customers’ authorization.

Richard Cordray’s Consumer Financial Protection Bureau issued a press release Sept. 8, 2016 laying out the bank’s sordid story and announcing a record CFPB fine of $100 million. After five years in existence, Wells Fargo was easily the biggest fish to be caught in the CFPB net.

“Wells Fargo employees secretly opened unauthorized accounts to hit sales targets and receive bonuses,” CFPB Director Cordray explained in the release. “Because of the severity of these violations, Wells Fargo is paying the largest penalty the CFPB has ever imposed. Today’s action should serve notice to the entire industry that financial incentive programs, if not monitored carefully, carry serious risks that can have serious legal consequences.”

To this day, the mega-bank is still struggling to avoid losing customers who were infuriated by the way they were treated.

House and Senate Democrats used the Wells Fargo trophy catch as an example of why President Trump should retain Cordray as the head of the CFPB (he would later resigned and run for governor of Ohio).

But a breakdown of the case by Brena Swanson of HousingWire.com shows Cordray and the CFPB had little to do with Wells Fargo getting caught with its hand in the proverbial cookie jar.

“Get past the proud press releases from government agencies, and you’ll find that one of the biggest financial scandals to ever be uncovered was revealed by journalists, not the Consumer Financial Protection Bureau or its director, Richard Cordray, as so many government officials like to give credit to,” Swanson writes.

She then chronicles the investigative series of reports by the Los Angeles Times and responsive investigations by the L.A. city attorney’s office.

On Dec. 31, 2013, the Times published an article titled, “Wells Fargo’s pressure-cooker sales culture comes at a cost,” by E. Scott Reckard.

The article unraveled the first-ever reports of Wells Fargo employees opening unneeded accounts for customers, ordering credit cards without customers’ permission and forging client signatures on paperwork to meet sales goals.

“The Los Angeles Times, on its own, came to this massive discovery from a review of internal bank documents and court records, and from interviews with 28 former and seven current Wells Fargo employees who worked at bank branches in nine states, including California,” according to Swanson.

By the time the Times reported on the situation, it had been going on for two years, “and it wasn’t until the whole story was published, printed and sitting in front Los Angeles City Attorney Mike Feuer that the city, not the CFPB, started an investigation.”

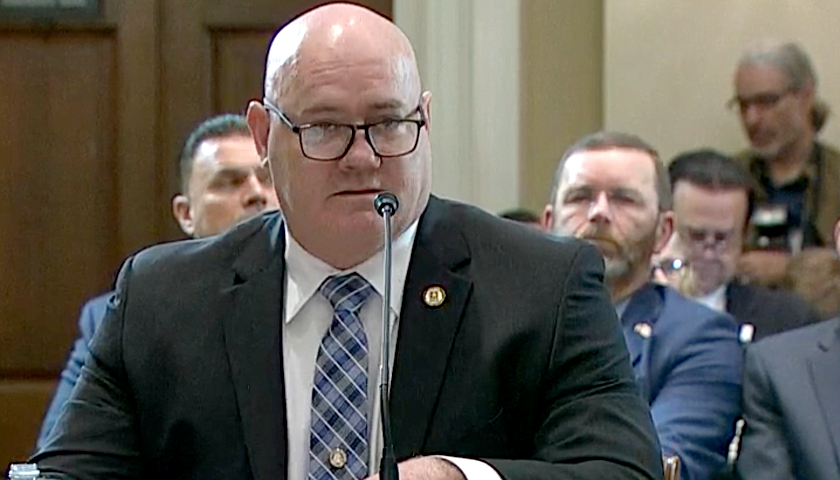

As Feuer stated in his testimony to the U.S. Senate Committee on Banking, Housing and Urban Affairs on Sept. 20, “On a Sunday morning in December, 2013, I was appalled when I opened the Los Angeles Times and read an investigative story by Scott Reckard regarding Wells Fargo Bank’s sales culture.”

“I immediately instructed my staff to investigate to determine if the facts warranted our office filing an action pursuant to California Laws that protect consumers against, and provide relief for, unfair business practices,” his testimony stated.

Feuer’s office also stated in its press release over the matter on Sept. 8, “In May, 2015, following an extensive investigation precipitated by a report in the Los Angeles Times, Feuer’s office sued Wells Fargo over the allegations of unauthorized accounts. After filing the lawsuit, the City Attorney received more than 1,000 phone calls and emails from customers and current and former Wells Fargo employees across the nation about the issues raised in the litigation.”

This all culminated in the CFPB, the Office of the Comptroller of the Currency and the city and county of Los Angeles levying a $185 million fine on Wells Fargo on Sept. 8, 2016, nearly three years after the original Los Angeles Times article. Swanson writes:

“Ultimately, the Los Angeles Times couldn’t levy a fine on Wells Fargo no matter how many awful facts it uncovered. The government and publications need each other and can operate alongside each other.

“However, Democrats in Congress have used and continue to use this specific case as its main weapon for why Richard Cordray needs to stay at the helm of the CFPB. There’s currently a war around Cordray, with Senate Republicans calling to have him fired and Democrats fighting to defend him.”

Democrats led by Rep. Maxine Waters (D-CA) penned a letter to President Trump in January, urging him to reject any attempts to deregulate Wall Street by removing Cordray prior to the expiration of his term in July 2018, highlighting his success in the Wells Fargo scandal.

Here’s an excerpt from the letter:

As Director of the Bureau, Mr. Cordray has continued his impressive record of taking on powerful special interests when they violate the law. To date, the CFPB has returned nearly $12 billion to more than 27 million consumers harmed by illegal, predatory financial schemes. Indeed, in the Bureau’s short five-year history, it has brought more than 100 cases against financial firms ranging from fraudulent debt collectors to payday lenders trapping borrowers in a cycle of debt. In September of this year, Director Cordray fined Wells Fargo more than $100 million for covertly opening unwanted deposit and credit card accounts on behalf of unsuspecting consumers. As the Attorney for the City of Los Angeles has stated, this historic enforcement action against Wells Fargo would likely not have occurred without coordination and collaboration with the Bureau, under the leadership of Director Cordray.

A group of Senate Banking Committee Democrats also wrote to Cordary around the same time, praising him for his outstanding work as director of the CFPB, emphasizing the need for his leadership at the agency in Trump’s Administration.

Here’s an excerpt from the letter:

The Bureau’s aggressive action against law-breakers has, to date, returned nearly $12 billion to the pockets of 29 million Americans – in addition to tough fines against banks, like the $100 million Wells Fargo paid the government for its unconscionable fake account scheme.

As The Ohio Star reported earlier this week, even the claim of “returning $12 billion” to consumers was highly inflated.

“Reading those letters, you would forgive people for thinking that the CFPB’s quick action was responsible for uncovering the scandal,” Swanson concludes. “In reality, the CFPB seemed to take a long time to act on the information available in that first 2013 article. In fact, a former insider at the CFPB even accuses the bureau of knowing about the situation and failing to making it a priority or take action.”

Anthony Accardi is a writer and reporter for The Ohio Star.