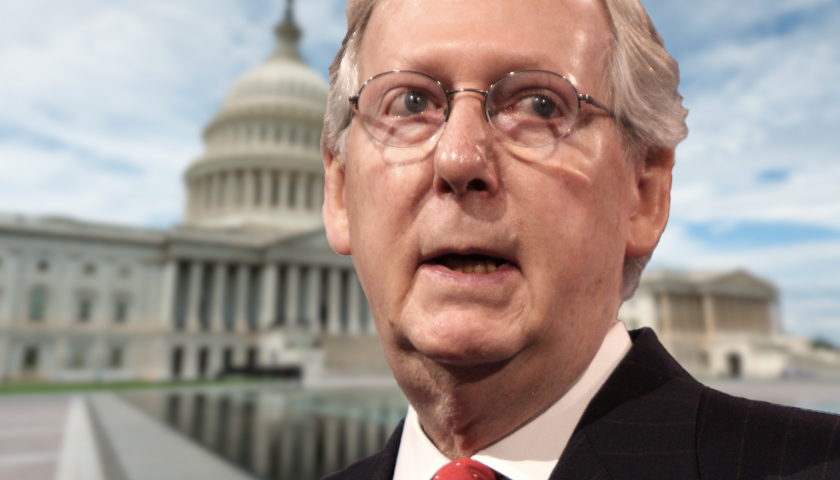

Congressional Republicans grabbed headlines this week after releasing an aggressive budget they say would cut taxes and spending, but key measures in the plan also would address one of the country’s most serious economic problems.

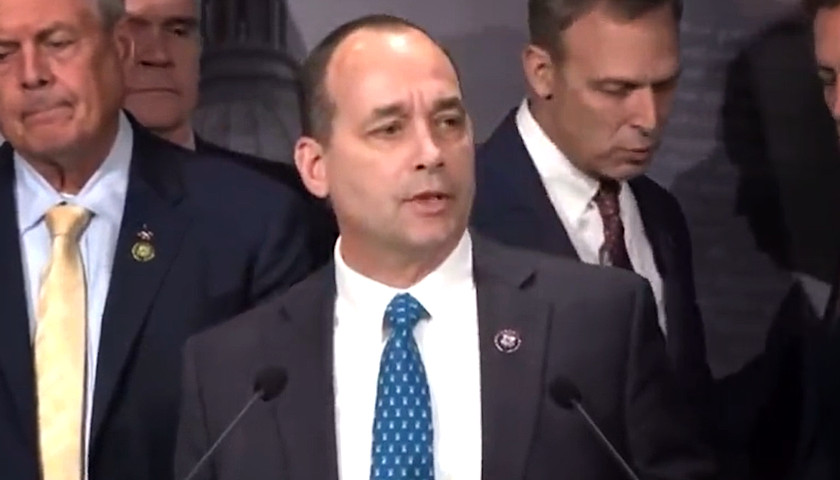

The House’s Republican Study Committee released a budget that lays out several measures to deal with inflation, a growing concern among economists after the latest federal data showed a spike in consumer prices. Notably, the index for used cars and trucks rose 10%, the largest one-month increase since BLS began recording the data in 1953. Food and energy costs rose 0.9% in the month of April, prescription drugs rose 0.5%, and gasoline rose 1.4% during the same month. The energy cost index rose 25% in the previous 12 months.

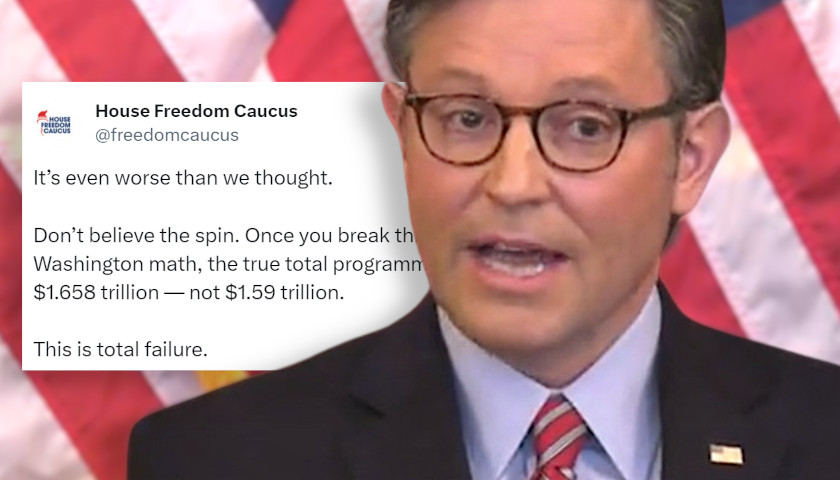

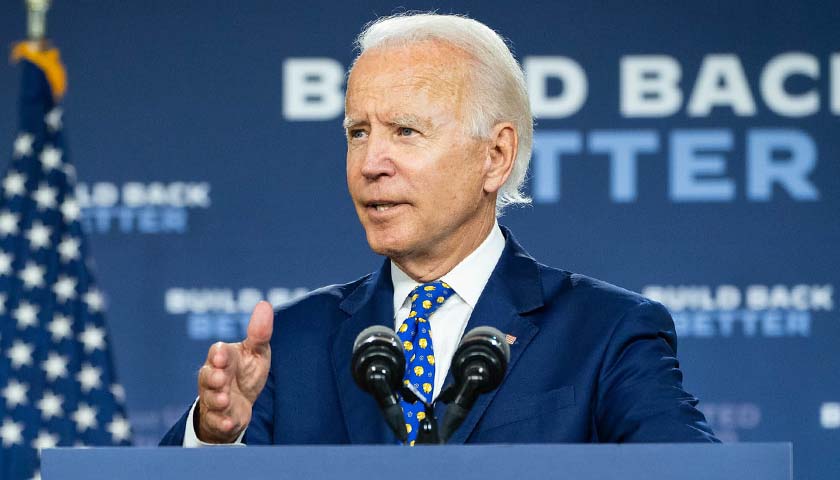

Republicans on the committee say their plan would address concerns over inflation by balancing the budget within five years, thereby eliminating the need to monetize debt, a process where the federal government prints money to make payments on what it owes. The national debt has soared to more than $28 trillion and is expected to continue climbing under President Joe Biden’s new spending plans.

Read More