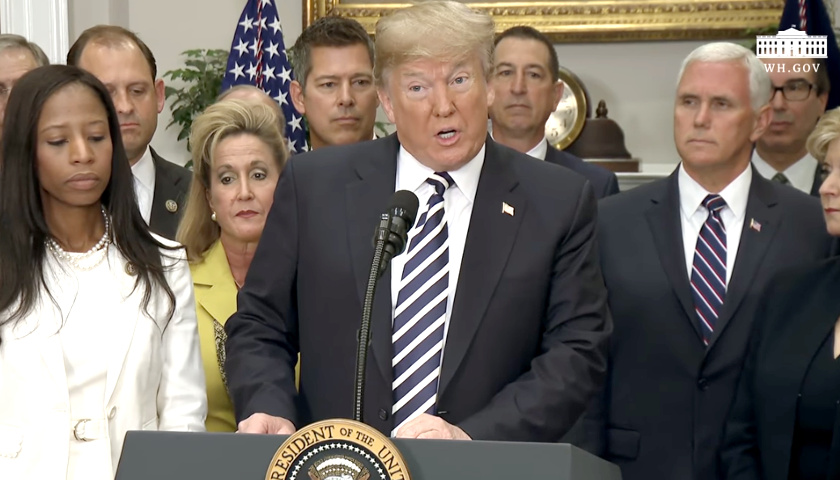

U.S. President Donald Trump signed into law Thursday a measure that eases rules imposed on banks in the aftermath of the financial crisis and the Great Recession that gripped the nation throughout President Obama’s first term, beginning in 2008.

The law relaxes regulations and oversight on banks with assets below $250 billion, leaving a handful of the largest U.S. banks that must still comply with the stringent rules and oversight.

Trump said at the signing ceremony the rules and oversight, enacted by the Dodd-Frank financial reform law, were “crushing small banks.” Trump lauded the signing as a victory in his administration’s efforts to eliminate regulations to promote economic growth.

“The legislation I’m signing today rolls back the crippling Dodd-Frank regulations that are crushing community banks and credit unions nationwide. They were in such trouble. One-size-fits-all — those rules just don’t work,” the President said during his remarks just prior to signing the bill into law at a ceremony Thursday morning.

He continued:

And community banks and credit unions should be regulated the same way. And you have to really look at this. They should be regulated the same way with proviso for safety, as in the past, when they were vibrant and strong. But they shouldn’t be regulated the same way as the large, complex financial institutions. And that’s what happened. And they were being put out of business one by one. And they weren’t lending.

Since its passage in 2010, Dodd-Frank has dealt a huge blow to community banking. As a candidate, I pledged that we would rescue these community banks from Dodd-Frank — the disaster of Dodd-Frank — and now we are keeping that commitment, and all of the people with me are keeping that commitment. Incredible group of people.

Dodd-Frank’s complex and costly regulations gave large banks an unfair competitive advantage at the expense of neighborhood banks all over the country. Since Dodd-Frank’s passage just eight years ago, 20 percent of small banks have been put out of business — they’ve disappeared — while banks that were considered “too big to fail” — we’ve heard that many time, “too big to fail” — had the resources to comply with Dodd-Frank’s brutal maze of costly regulations. And maybe we’re going to have to start looking at that also for the larger institutions because they also are put at a disadvantage in terms of loaning money to people wanting to open up businesses. So perhaps we’ll be taking a look at that. Many small banks were forced to shut down.

Regulations also made it nearly impossible for new banks to replace the ones that went out of business. Made it totally impossible to open up new. Almost nobody opened up new. In the past, scores of new banks formed every single year. In recent years, that number has plummeted, again, to almost zero.

These community banks are vital for local lending and have a direct stake in the success of their neighborhoods and their states. Local businesses have few other resources and few other ways of getting credit. And for many Americans, these small banks are the only financial institutions in their entire community. They made their communities work, and they’ve been essentially shut down.

When these community banks close their doors, it denies small businesses and everyday Americans access to capital that they desperately need. By liberating small banks from excessive bureaucracy — and that’s what it was: bureaucracy — we are unleashing the economic potential of our people.

This legislation also strengthens protections against identity theft — big problem nowadays; bigger than anyone understands — expands crucial financial access to low-income and minority communities, and ensures that educational and job-training opportunities are available to more families in need. Those are great opportunities. Some of the people up here are working very, very hard on creating those opportunities for people. These reforms are critical to helping all Americans thrive and to prosper.

Today’s legislation is the next step in America’s unprecedented economic comeback. There’s never been a comeback like we’ve made. And one day, the fake news is going to report it. (Laughter.) But that’s okay — you’ve been very nice, actually today. You’ve been extremely nice.

Republicans in Congress passed the biggest tax cut and reform in the history of our country. We passed and signed a record number of bills terminating job-killing regulations. In the history of our country, no President — whether it’s four years, eight years, or sixteen years, in one case — has ever passed more regulation cuts. And these were necessary cuts, because we’re leaving necessary regulations. Regulation is fine, but it’s got to be reasonable. And that’s what we’ve done.

Unemployment has reached its lowest level in nearly two decades. African American unemployment has reached its lowest level in history. And the same thing for Hispanic unemployment — lowest level in history. Women — lowest level of unemployment in 19 years. Small business optimism has never, ever been higher, according to polls and charts.

And we’re restoring our forgotten communities by fighting to reclaim the stolen manufacturing jobs. You see that happening right now. You see what’s going on with cars, where Secretary Ross and I, and as you know, Secretary Mnuchin, Lighthizer, and the whole group, we’re all working together — Peter. We have a big group working together.

But you see there was an article today, but it’s going to be more than an article. Cars — cars pouring into our country and hurting our jobs, and they’re closing. But they’re moving back. As you know, Chrysler is moving back to Michigan. Big plant. Many car companies are coming into our country now. Big difference.

But if you take a look at what we’re doing on trade — China — going to be much different. A lot of reporting doesn’t have it right, because we’re not talking about the deal we’re trying to make. We don’t want to do that. But we’re working very well and very hard with China. As you know — and I don’t blame China for this — China has been — taken advantage of the United States economically, and in other ways, for many, many decades. For many decades. And it was like missing in action, our representatives. They were missing in action. They wouldn’t do anything. We had a trade deficit last year with China of at least $375 billion, and I believe the number was probably over $500 billion. And we had massive theft of intellectual property to the tune of perhaps — hard to value — $300 billion a year. And that’s all ending. That’s all ending.

And our relationship with China is a very good one. And I told President Xi, I don’t blame China. I blame the United States for allowing this to happen, because people in my position and people in these positions should have never, ever allowed that to happen. But we’re changing it.

This is an incredible time for America. Amazing progress is happening for our country every single day. And I, again, want to thank the members of Congress who helped pass so many vital legislative acts. And we have another one that passed yesterday called Right to Try. Nobody knows what that means. That’s a patient who’s terminally ill, ends up leaving the country to find help. They wanted hope. And we have drugs that are in the pipeline for anywhere from 10 to 15 years, and they may be very good but you’re not allowed to use them. These people are terminal. They’re terminally ill. They’re going to die, and we have no access — they have no access at all to getting into that pipeline to getting something that may or may not work.

We have some incredible — at the FDA, we have some incredible drugs under research. So Right to Try, which amazingly was something that everyone said could not be passed — Right to Try passed, and we’ll be signing it probably sometime next week. And this gives people hope.

We can go, they’ll sign a waiver, and they’ll be able to use what they need. And in many cases, they’ll be helped. But they won’t have to fly to Africa. They won’t have to fly to South America. They won’t have to fly to Europe or wherever just seeking help. Rich people, poor people, they’re seeking help. They had no access. Now they have the right to try. The right of hope.

And I know many of the folks standing with me agreed with me and approved it. It’s such a wonderful bill. And it’s so incredible that is was not possible to get it passed, but we got it passed. And we had some tremendous help from some tremendously talented senators and Congress people.

So I want to thank all the people up here today. What we’re doing today, with respect to Dodd-Frank, is truly important legislation. And I have to say, for a Congress that they say, you know, won’t be doing much because we have an election coming up, I think we’re doing an awful lot, when you think about it.

Although the passage of S.2155 does not repeal Dodd-Frank completely, it does curb several key powers that have hurt many smaller community and regional banks.

The same legislative session that passed the Affordable Care Act – nicknamed ‘Obamacare’ – took up Dodd-Frank, and was quickly signed into law by President Barack Obama in 2010 at the height of the financial crisis fueled by risky mortgage lending practices mandated by and expansion of the “Communities Reinvestment Act.” Along with poorly documented and highly speculative financial products based on them – the collapse of the American real estate and investment marketplace resulted in the loss of 8 million jobs, 2.5 million home foreclosures and the shuttering of 2.5 million businesses, according to Northwestern University’s Institute for Policy Research.

Watch the entire ceremony:

– – –

VOA News contributed to this report