by Bob McEwen

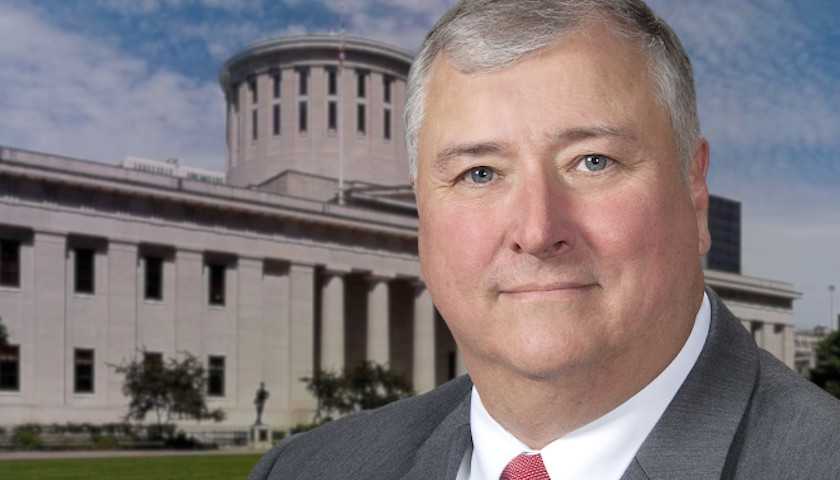

Last month’s indictment of now former Ohio Speaker Larry Householder, which brought to light a $60 million bribery scheme, has rocked Columbus and thrown our state’s politics into disarray. Ostensibly undertaken to enact H.B. 6, the sweeping energy policy bill known as the Ohio Clean Air Program, the legislation has proven to be little more than a handout for special interestscourtesy of average citizens.

One of the biggest backers of the legislation is First Energy Corporation, an electric utility based in Akron that serves consumers throughout the region. While the company is profitable, one of its subsidiaries, First Energy Solutions – since renamed Energy Harbor – operates two nuclear plants in the state, Davis-Besse outside of Toledo, and Perry northeast of Cleveland, which they allege are losing money.

When lawmakers were considering H.B. 6 Energy Harbor argued that unless lawmakers approved about $1 billion in surcharges on residential and commercial customers, it would likely have to close the facilities and lay off over 4,000 workers. At the time, there was skepticism about the claim but the company said it could not corroborate it because it would require them to disclose proprietary information.

A year later, we have a more complete picture and, in the words of the Cleveland Plain Dealer, the story has taken “a disgusting turn.” Energy Harbor is buying back $800 million in stock to boost share value for investors. This suggests Energy Harbor was not struggling to get out from under the weight of the white elephants the nuclear facilities were purported to be. And that means ratepayers and taxpayers battered by the economic fallout of the coronavirus pandemic will subsidize Energy Harbor as the company rewards its shareholders and investors.

In contrast, there seems to be no broad public benefits in the windfall for Energy Harbor enabled by H.B. 6. Socializing losses and privatizing gains will do nothing to advance Ohio’s long-term energy diversification strategy. The surcharges that customers will be paying for the next five years are not being deployed to spur the development of new technologies or to make energy production and consumption more environmentally friendly or efficient. The stock buy-back simply diverts money from ratepayers to investors.

At a time when so many people in Ohio are reeling from personal losses and economic uncertainty, it is outrageous that such cronyism persists. What is going in Ohio with Energy Harbor’s stock buy-back is today’s most glaring example of policymaking distorted by special interests with disproportionate clout. If, as we now see, the two nuclear plants can operate without bailouts, instead of buying back its stock to benefit shareholders, Energy Harbor should be scaling back surcharges to benefit its customers.

Fortunately, there’s an ongoing effort to repeal HB-6. Forthcoming legislation in both the state House and Senate would eliminate the subsidies. In light of these stock buybacks and indiscretions by Householder, the state should repeal the subsidies and embrace more innovative, competitive, and clean fuels like natural gas. It will serve as the first step in redressing the former Speaker’s corruption and will position the state to adopt an all of the above policy that reduces energy costs, lowers emissions, and allows competition amongst fuel sources.

– – –

Former U.S. Rep. Bob McEwen represented southern Ohio in Congress for six terms.