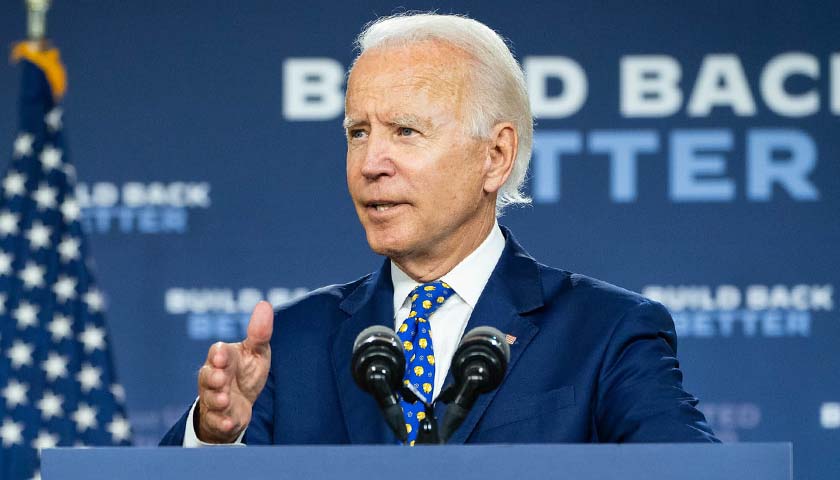

President Joe Biden’s State Department paid a public university to train a cohort of “master trainers” in India who will then go on to train more than two thousand people to become “LGBTQI+ allies,” according to a government spending database.

Washington State University received (WSU) $15,000 from the State Department in July 2023 to hold a three-day workshop aimed at training 30 individuals with the goal of them eventually training 2,500 people to become “LGBTQI+ allies” and to develop a “better understanding of diversity and inclusion,” according to a federal spending database. The trainings took place in India between Sept. 25 and Sept. 27, according to the university website.

Read More