I write now, in the worst pain and shock, with news of my friend Joe Lieberman’s death just moments ago. I write because I know what his critics will be quick to write, what news reports have already re-circulated.

Read MoreTag: George W. Bush

Politicians of All Stripes Focus on Post-Election Audits Before 2024 General Election Even Happens

Various state legislators are focusing on post-election audits ahead of the November 2024 general election, with Republicans looking to implement or improve audits in some states, while Democrats in one state are trying to prevent an audit of the presidential election.

Post-election audits have been on the books of some states for years, most famously, the “hanging chad recount” fought over in 2000 between George W. Bush and Al Gore, which was decided by the Supreme Court of the United States. The issue of post-election audits and the ensuing litigation has received renewed attention since the 2020 presidential election, after numerous irregularities were discovered. The Arizona Senate post-election audit was one of the more famous following the 2020 race. Dispositive evidence that irregularities “moved the needle” one way or another is still a point of contention.

Read MoreObama, Bush and Clinton Have Started an NGO to Fly Migrants into America

American Express Global Business Travel and Welcome.US have reportedly teamed up with former Presidents Obama, Clinton and George W. Bush’s nongovernmental organization (NGO) called Miles4Migrants to fly migrants to communities across the U.S.

Welcome.US is an NGO that was initially launched to work with President Joe Biden’s administration to facilitate some of the 85,000 Afghans who came into the U.S. in 2021 and 2022 after the debacle created when the U.S. evacuated from Afghanistan, according to Breitbart.

Read MoreCommentary: Things Are Much Worse That They Seen as ‘Digital McCarthyism’ Is On the Move

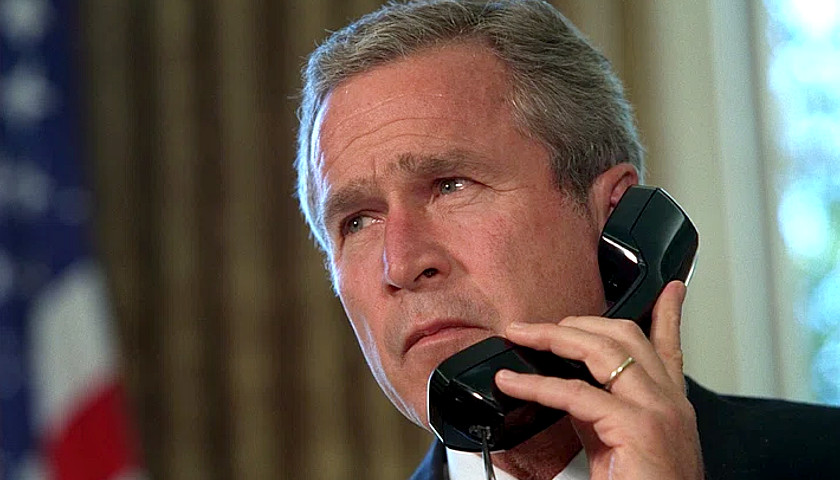

On September 14, 2001, George W. Bush, exercising “the power vested in [him] as President of the Untied States,” issued Proclamation 7463, a “Declaration of National Emergency by Reason of Certain Terrorist Attacks.” That got the ball rolling on the construction of the surveillance state.

At the time, the extreme measure seemed justified. Three days earlier, the United States had suffered its most devastating terrorist attack in history.

Read MoreCommentary: Is Former Vice President Mike Pence’s View on Conservatism Correct?

Former Vice President Mike Pence in a speech before the New Hampshire Institute of Politics at Saint Anselm College and in an article in The Wall Street Journal warned Republicans and conservatives about the danger of populism. The former Vice President argues, in echoing Ronald Reagan’s 1964 address, that it is “a time for choosing” for Republicans whether to continue to follow the “siren song” of populism or return to true conservatism. It is clear that Pence is not only drawing a line in the sand and forcing a debate over conservatism, but also distancing himself from former President Donald Trump and those who support his policies. Nevertheless, Pence fails to understand that the conservative populism he is denouncing is actually rooted within the American conservative tradition.

Read MoreFormer Presidents Obama, Bush, and Clinton Team Up with American Express and ‘Welcome.US’ to Fly Migrants into the U.S.

American Express Global Business Travel and Welcome.US have reportedly teamed up with former Presidents Obama, Clinton, and George W. Bush’s nongovernmental organization (NGO) called Miles4Migrants to fly migrants to communities across the U.S.

Welcome.US is an NGO that was initially launched to work with President Joe Biden’s administration to facilitate some of the 85,000 Afghans who came into the U.S. in 2021 and 2022 after the debacle created when the U.S. evacuated from Afghanistan, according to Breitbart.

Read MoreOhio Senate Passes Bill Expanding College-Savings Deduction

The Ohio state Senate on Wednesday unanimously passed legislation to permit more families to take advantage of an income-tax deduction that incentivizes saving for college.

The measure sponsored by Senators Jay Hottinger (R-OH-Newark) and Andrew Brenner (R-OH-Delaware) applies the deduction to all savings programs nationwide established under Section 529 of the federal Internal Revenue Code. Current law allows Ohioans to take the deduction only for contributions to Ohio’s own 529 program.

Read MoreCommentary: Reflections on Calm Before Storm of 9/11 and Peace of Providence After

Sept. 11, 2001, dawned in Washington as the most beautiful day of that year and one of the most beautiful days I have ever experienced.

I left my home in Northern Virginia early that morning. The route to the White House was always inspiring because of its historic evocation along the way—driving around the Lincoln Memorial each day after having come across the Memorial Bridge from Arlington into Washington, with the Vietnam Memorial on the right-hand side.

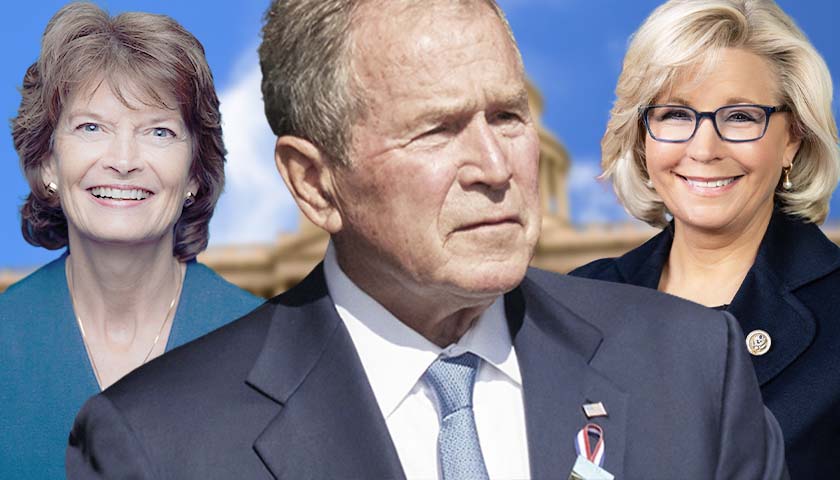

Read MoreFormer President George W. Bush Donates to Pro-Impeachment Republicans

Former President George W. Bush’s most recent donations to Republican candidates included maximum contributions to the campaigns of two Republicans who voted in favor of impeaching President Donald Trump.

Politico reports that the only donations made by the 43rd president in the year 2021 were to the campaigns of Congresswoman Liz Cheney (R-Wyo.) and Senator Lisa Murkowski (R-Alaska). Bush gave the maximum possible amount of $5,800 to Cheney in October, while also giving $2,900 to Murkowski’s campaign. According to FEC filings, Bush had also previously donated to Cheney’s first campaign for the House of Representatives in 2016; Cheney is the daughter of Bush’s former Vice President Dick Cheney.

Both represent small portions of each candidates’ respective war chests, with Cheney finishing the year with $1.9 million and Murkowski raising $4.7 million; but the symbolism of the former president only donating to Republicans who voted to impeach President Trump speaks volumes about the ongoing divide between the previous generations of Republican leadership and the rising “America First” movement, led by Trump.

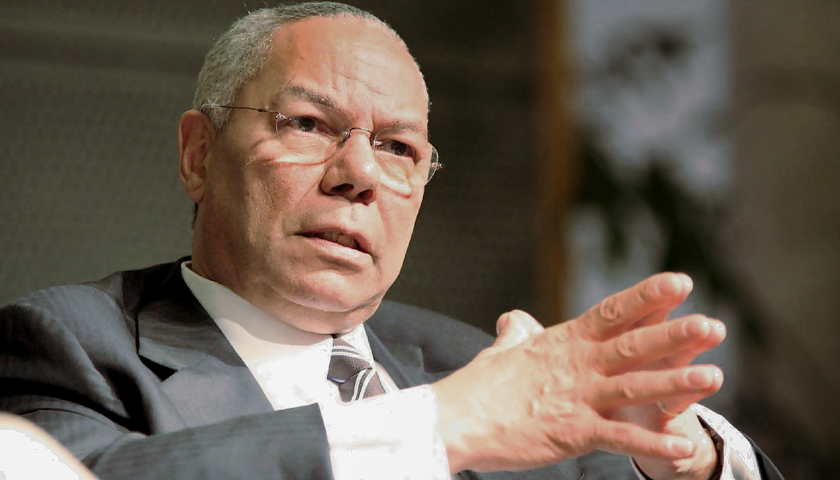

Read MoreColin Powell, First Black Secretary of State, Dead at 84 of COVID-19 Complications

Former Secretary of State Colin Powell died Monday morning due to complication from COVID-19, according to his family. He was 84.

Powell was the first black U.S. secretary of state, serving in the second Bush administration from 2001-2005. From 1989-1993, he served as the chairman of the Joint Chiefs of Staff during the presidency of George H.W. Bush.

He was fully vaccinated, the family said.

Read MoreCommentary: A.G. Garland’s Use of Police Power Against Parents Could Be His Undoing

Destruction of the family has always been at the center of the collectivist project. In chapter two of The Communist Manifesto, Marx and Engels point out that the destruction of private property will never be complete until the “abolition [Aufhebung] of the family” is accomplished. The dream is perennial among snarling misanthropists. A couple of years ago, an interview in The Nation with a radical feminist explained that if you “want to dismantle capitalism” then you have to “abolish the family.”

It is worth keeping that in mind as the little drama of Merrick Garland versus the parents of America unfolds. I wrote about the attorney general’s absurd but troubling memorandum shortly after it was released on October 4. As all the world knows (but only some precincts of the world admit), Garland threatened to mobilize the entire police power of the state against parents. Why?

Read MoreCommentary: Democrats Repeat the Mistakes of 2016

As we get to the midpoint between the last presidential election and next year’s midterms, all political sides are expending extraordinary effort to ignore the 900-pound gorilla in the formerly smoke-filled room of American politics. This, of course, is Donald Trump.

The Democrats are still outwardly pretending Trump has gone and that his support has evaporated. They also pretend they can hobble him with vexatious litigation and, if necessary, destroy him again by raising the Trump-hate media smear campaign back to ear-splitting levels.

Read MoreCommentary: The Treacherous Road to Runaway Inflation

In January, 2001, America had a balanced budget, low debt, and was at peace. Here, briefly, is what lay ahead: war, financial crisis, civil unrest, massive growth of the federal government, and now severe inflation.

Never in the history of America has our government in its ineptitude created such a false economy, risking hundreds of years of hard work on unsound and unworkable economic policies. The Founders wisely relied on dispersion of power. They knew there would be dishonest and incompetent politicians but, in this case, the entire government is infected with deceptive leaders.

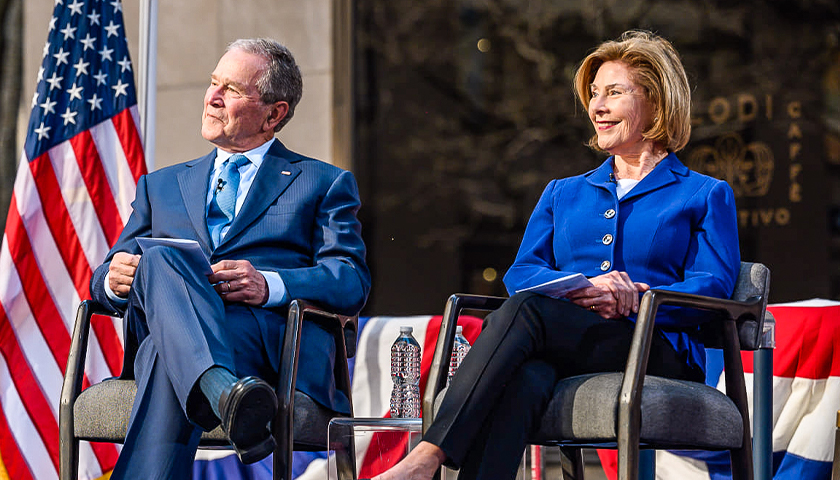

Read MoreCommentary: The ‘Foul Spirit’ of George W. Bush and America’s Ruling Class

As with so many other aspects of our time, we seem destined to suffer the most trite and underwhelming imitations of things that once were great or at least impressive. Exhibit A would be the great war advocate, George W. Bush. Can there be a more perfect synthesis of the last 20 years of disappointing American politics than this man? He exemplifies everything—unaware, unashamed, unapologetic—that the American ruling class has become. NeverTrumpers and neocons yearn for a return to the days of measured, steady Bush leadership. We are told constantly now that he is kind, polite, well-bred: a politician from a more dignified tradition of public servants than those of late. But of course, in reality he is none of these things.

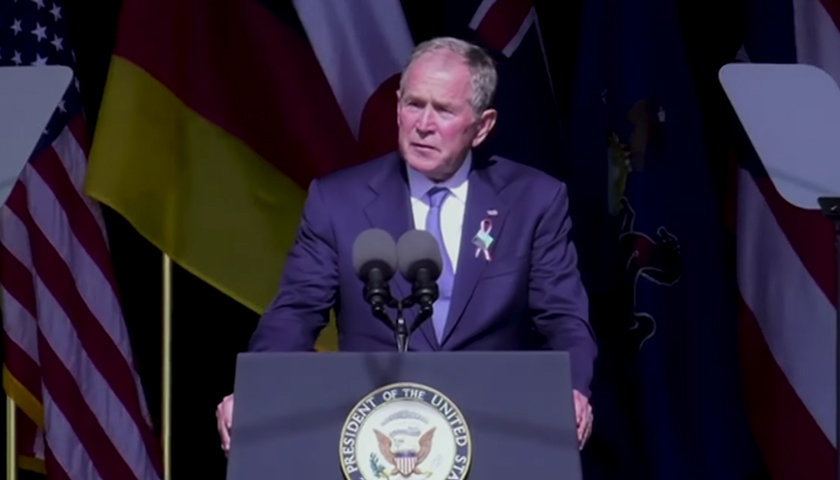

The everlasting incompetence and mesmerizing self-delusion on display at his recent 9/11 remarks make that clear.

Read MoreBush’s 9/11 Remarks on Domestic Extremism ‘Not Exclusive to January 6’ Riot, Spokesperson Says

Former President George W. Bush’s remarks about domestic extremism during his speech in Shanksville for the 20th anniversary of 9/11 were “definitely not exclusive to” the January 6th Capitol riot.

Speaking at the Flight 93 memorial, Bush compared violent extremists in the U.S. and foreign extremists.

“There is little cultural overlap between violent extremists abroad and those at home,” Bush said on Saturday at the memorial in Pennsylvania. “But in their disdain for pluralism, in their disregard for human life, in their determination to defile national symbols, they are children of the same foul spirit and it is our duty to confront them.”

Read MoreEXCLUSIVE: Republican Attorneys General Plan to Create Legal Roadblocks for Biden Agenda

Republican attorneys general are determined to mount numerous legal challenges against President Joe Biden, creating a formidable roadblock to the president’s agenda.

In less than three months since President Joe Biden was sworn into office, Republican states have waged war on his agenda, suing the administration on climate change, energy, immigration and taxation policy. But the conservative attorneys general who started filing the lawsuits in March said they aren’t done yet and expect to continue challenging the administration in court.

“We are sharpening the pencils and filling up the inkwells,” Louisiana Attorney General and former Republican Attorneys General Association Chairman Jeff Landry, who is leading two of the ongoing lawsuits against the Biden administration, told the Daily Caller News Foundation.

Read MoreHundreds of Bush Administration Officials Declare Support for Joe Biden

A large group of officials who worked for former President George W. Bush will endorse the former Democrat Vice President Joe Biden.

The group formed a super PAC Wednesday, called “43 Alumni for Biden,” a reference to Bush, the 43rd president and described its formation as an effort to restore “the principles of unity, tolerance and compassion to the greatest elected office in the world,” according to Reuters.

Read MoreFormer President George W. Bush on Riots: ‘Protest Shows Strength’

Former President George W. Bush weighed in Monday on the riots that have torn across the United States, saying that “lasting justice will only come by peace.”

Bush spoke out following the seventh night of destructive riots following the demise of George Floyd, a black man who died after a Minneapolis police officer knelt on his neck for several minutes, according to footage of the incident.

Read MoreCommentary: Globalism Is Not Slowing Down Anytime Soon

Nothing, not even a pandemic, will dissuade the people who brought us globalization to modify, halt, or roll back the decisions they have made for us. As I was scrolling through Twitter, I came across these gems. First, there was this tweet from the George W. Bush Presidential Center. It links to an article which tells us that calling for Americans to start to “Make it here at home” has a nice ring to it, but we must have no illusions: “Restricting trade and using taxes, tariffs and subsidies to manipulate the market can only be done by dramatically reducing freedom. That path leads to poverty.”

Read MorePlain Dealer Shows It Is Just Plain in the Democrat’ Corner with Dehumanizing Editorial Against Rep. Jordan

Democrats have a friend in The Plain Dealer.

Cleveland’s establishment newspaper has morphed into the Buckeye State’s PR Branch for the Democratic Party.

Read MoreHistorian: Trump ‘Far Ahead’ of His Predecessors on Media Availability

President Trump has had far more contact with reporters than any other president, according to an award-winning presidential historian. Scholar Martha Joynt Kumar, who specializes in White House communications and presidential transitions, said that as of the end of June, Trump had had 442 exchanges with media reporters.

Read More