by J.D. Davidson

Ohioans could soon catch a break with their property taxes if the Senate agrees with recently-passed House legislation that ties those taxes to inflation.

House Bill 57 unanimously passed and heads to the State Senate, without any opposition in committee. It’s yet to be introduced in the state’s upper chamber.

According to State Rep. Thomas Hall, R-Madison Township, the bill would index the state’s homestead exemption to inflation, decreasing inflationary risk for Ohio seniors and disabled veterans.

“Inflation is high and impacts every single Ohioan, especially those who live on fixed incomes, such as seniors and disabled veterans,” said Hall.

The Ohio Poverty Law Center said tying homestead to inflation would grow the number of people who benefit immediately. The group also encouraged lawmakers to expand those eligible to receive the exemption.

“This change would increase the number of people who could benefit from the exemption right now in a time of record inflation, along with record increases in property values,” testified Danielle DeLeon Spires, a policy advocate with the Ohio Poverty Law Center. “While any expansion of this exemption is a benefit to an aging population, a step to expand the income eligibility requirement would take another necessary step in further support. Expanding this opportunity will allow for more Ohioans to remain in their homes as they age and provide stability amidst rising economic costs.”

David Root, state legislative chairman of the Department of Ohio VFW, said the move could also play a role in limiting veteran suicide.

“While the VFW national organization is working with our national legislators to look at these things as a way to reduce veteran suicide, we can work together to reduce the risk of suicide here in Ohio. Housing is one of the ways,” Root testified.

The House also passed HB66, which would allow wholesalers who have a bad debt from a retailer to claim a refund from the state for the tax paid up front.

“This crucial tax return bill will support our wholesalers and help them better compete in the current market,” said Hall.

– – –

An Ohio native, J.D. Davidson is a veteran journalist at The Center Square with more than 30 years of experience in newspapers in Ohio, Georgia, Alabama and Texas. He has served as a reporter, editor, managing editor and publisher.

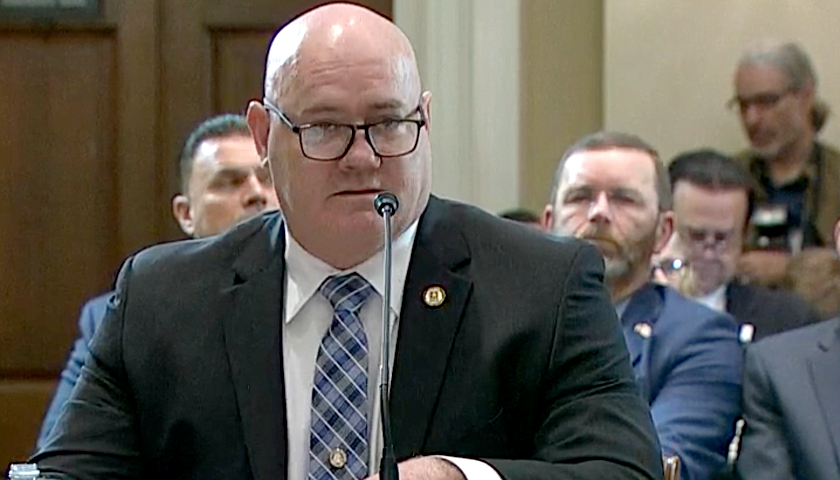

Photo “Thomas Hall” by State Representative Thomas Hall. Background Photo “Ohio State Capitol” by Ɱ. CC BY-SA 4.0.