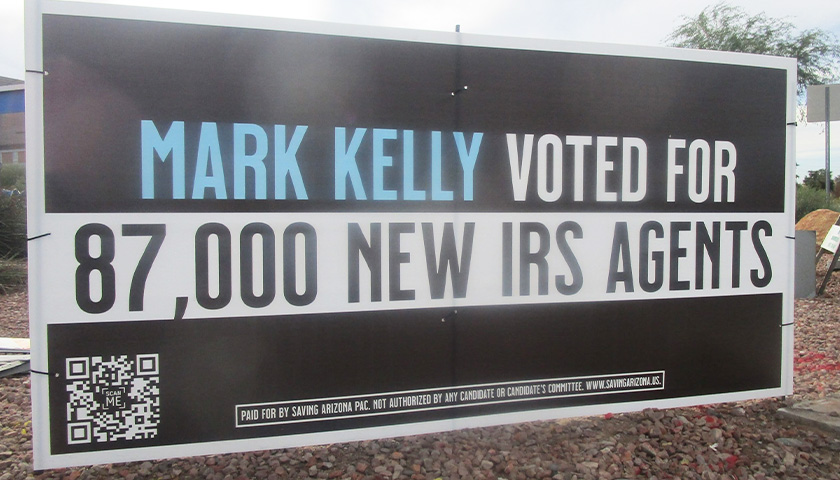

The House Judiciary Committee has opened an inquiry to whether the IRS is using artificial intelligence to invade Americans’ financial privacy after an agency employee was captured in an undercover tape suggesting there was a widespread surveillance operation underway that might not be constitutional.

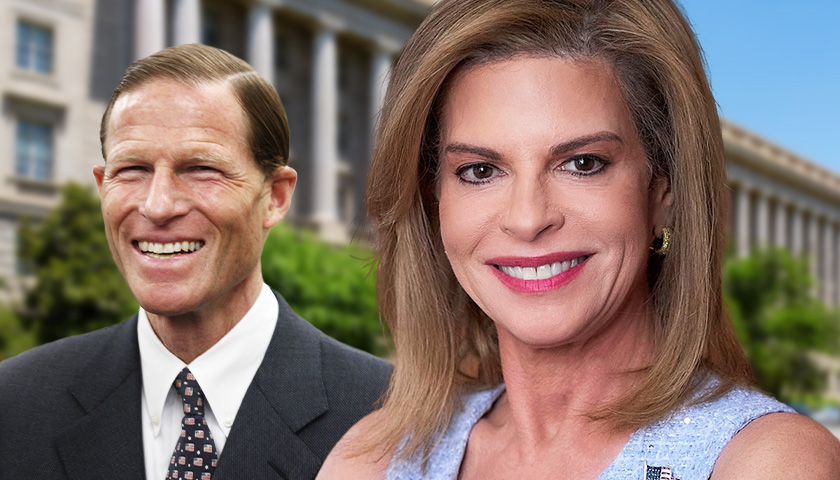

Committee Chairman Jim Jordan, R-Ohio, and Rep. Harriet Hageman, R-Wyo., sent a letter last week to Treasury Secretary Janet Yellen demanding documents, and answers as to how the agency is currently employing artificial intelligence to comb through bank records to look for possible tax cheats.

Read More