by J.D. Davidson

Emergency legislation enacted at the beginning of the COVID-19 pandemic that changed the way municipal income taxes were handed out to cities is now in front of the Ohio Supreme Court.

The Buckeye Institute, a Columbus-based policy group, originally filed suit in July 2020, challenging the state law that requires an employee to pay income taxes in the city where an employee works instead of where they live.

Gov. Mike DeWine’s stay-at-home order meant employees worked from home rather than commuting to work in another town. The General Assembly, however, passed an emergency law that continued tax payments to cities, even though work was not performed in those cities.

The state forced people to work from home, but deemed their work to have been performed in a higher-taxes office location, according to The Buckeye Institute. That, the group said, is unconstitutional.

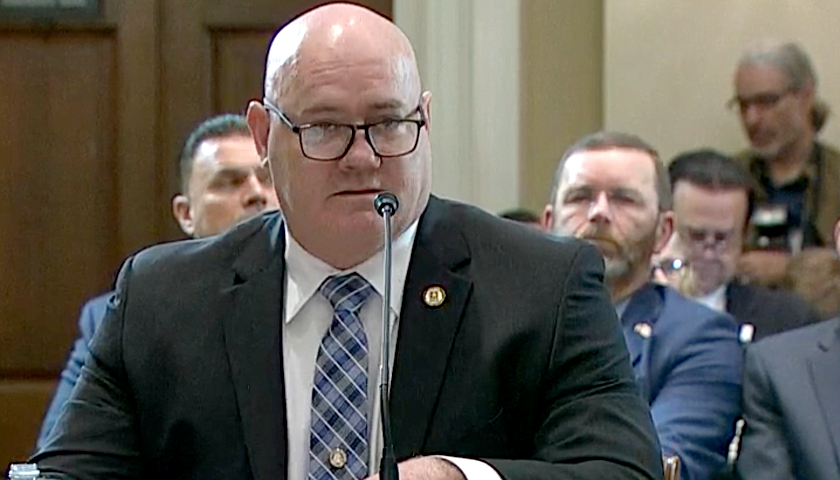

“The Ohio Supreme Court has held – time and again – that Ohio’s Constitution allows cities to tax nonresidents only on the work that is actually performed in the city,” said Jay Carson, senior litigator for The Buckeye Institute. “The Buckeye Institute is asking the Ohio Supreme Court to reaffirm that established and commonsense limits on municipal taxation, and the Due Process Clause, apply – even during a pandemic.”

The Buckeye Institute originally filed on behalf of its employees against the city of Columbus. Both the original court, as well as the Ohio Tenth District Court of Appeals, ruled in favor of the city.

Four other suits were filed on behalf of other plaintiffs. One was settled, one is before the First District Court of Appeals and two others remain in the court system.

Members of the Ohio General Assembly also filed an amicus brief to the Ohio Supreme Court in support of The Buckeye Institute.

“The original intent and plain language of the legislative language was not recognized and properly applied in this case by the Tenth District Court of Appeals. This fundamental failure will likely adversely affect hundreds of thousands of Ohio citizens who could be deprived of rights to obtain refunds of tax remitted to municipalities by their employer,” the brief said.

The National Taxpayers Union Foundation also filed an amicus brief in support of Buckeye’s case.

– – –

J.D. Davidson is a veteran journalist with more than 30 years of experience in newspapers in Ohio, Georgia, Alabama and Texas. He has served as a reporter, editor, managing editor and publisher. He is a regional editor for The Center Square.