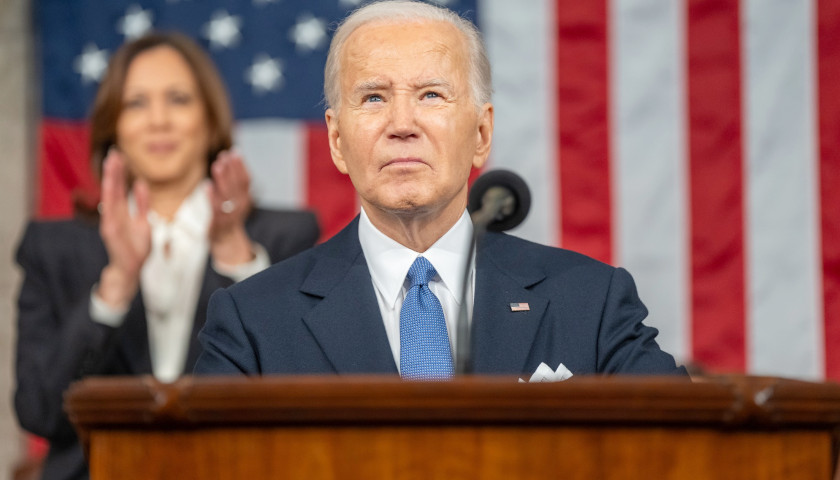

The State of the Union is not strong. Americans are facing a cost-of-living crisis, high crime, and an unsecured southern border as a direct result of Democrats’ failed policies led by perpetrator-in-chief Joe Biden.

Instead of taking accountability for these pressing national challenges, Biden promised more of the same in his State of the Union address Thursday night.

Read More