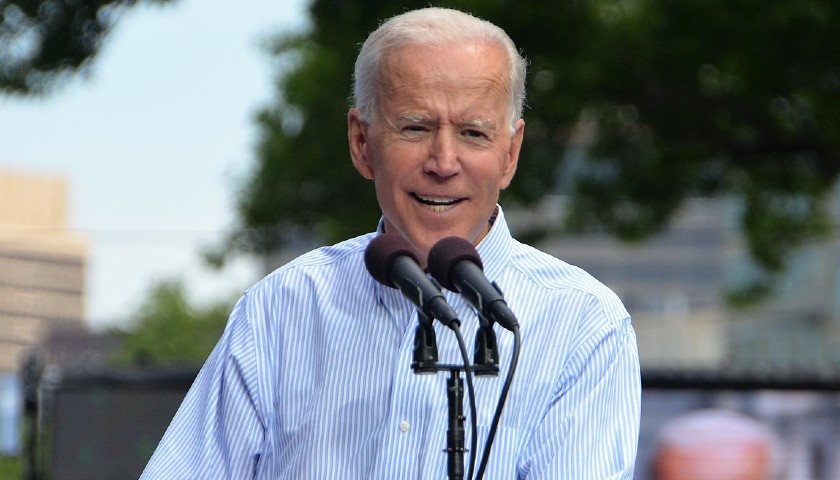

House Democrats will consider nearly $3 trillion in tax hikes over the next decade in an attempt to pay for their $3.5 trillion budget that includes most of President Joe Biden’s domestic agenda and would overhaul the nation’s social safety net.

The hikes are predominantly focused on wealthy Americans and large corporations. Among the increases is a top income tax bracket of 39.6%, up from 37%, which Democrats say would raise $170 billion in revenue over the next decade.

A summary of the proposals leaked Sunday, and was first reported by The Washington Post.

Read More