by Shirleen Guerra

Former President Donald Trump said he would end the funding for homeless immigrants in hotels if elected president.

“Under crooked Joe Biden, the U.S. government has spent nearly $1 billion to house illegal aliens and foreign migrants in expensive, luxury hotels courtesy of you, the American taxpayer, and they want to spend billions and billions more,” Trump said in a video message posted on his social media platform. “In many states, we are running out of hotel space because the rooms are all booked up with illegal aliens living in a very large way on the American taxpayers’ dime.”

Trump said there were 33,000 veterans who were homeless “living very poorly” and “nobody is doing a thing for them.”

“When I am re-elected, this national scandal will end,” Trump said in the video.

Trump is the leading Republican candidate for the presidency.

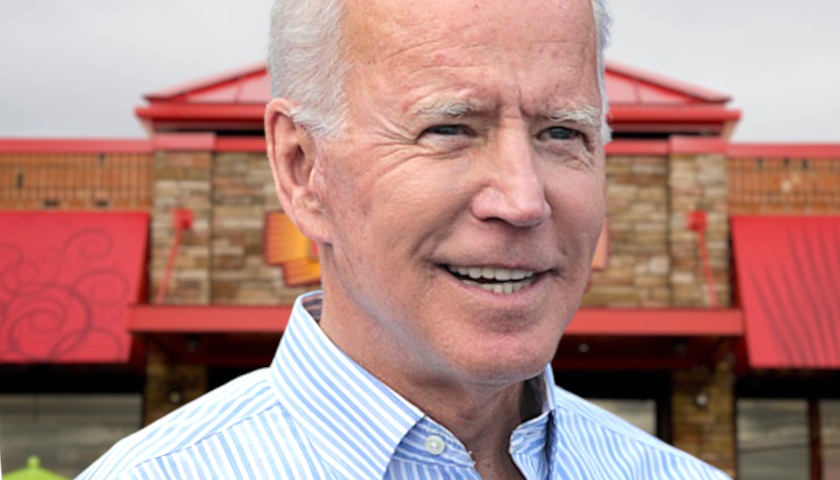

Biden announced in June that his administration was launching supportive services to help find housing for homeless veterans. Biden said that his administration was spending $3.1 billion across the country to find housing for homeless people, including veterans.

Veterans Affairs Secretary Denis McDonough said in May that the Veterans Affairs helped 40,000 homeless veterans find homes in 2022, according to a media release.

Communities across the country have used hotels to house homeless people. The homeless issue has been spurred, in part, by the increase in migrants into the U.S.

Chicago and New York have made the news for the billions they have had to spend to house the flood of migrants who have come to their states.

California, Colorado, Washington and Arizona are some of the states spending millions buying hotels and putting homeless people up in their own rooms.

In Los Angeles, a 2024 ballot initiative would require hotels to use vacant rooms to house homeless people who would stay in rooms besides paying customers.

– – –

Shirleen Guerra is a staff reporter for The Center Square. Shirleen attended Odessa College where she completed an apprenticeship through The Odessa American where she previously freelanced.