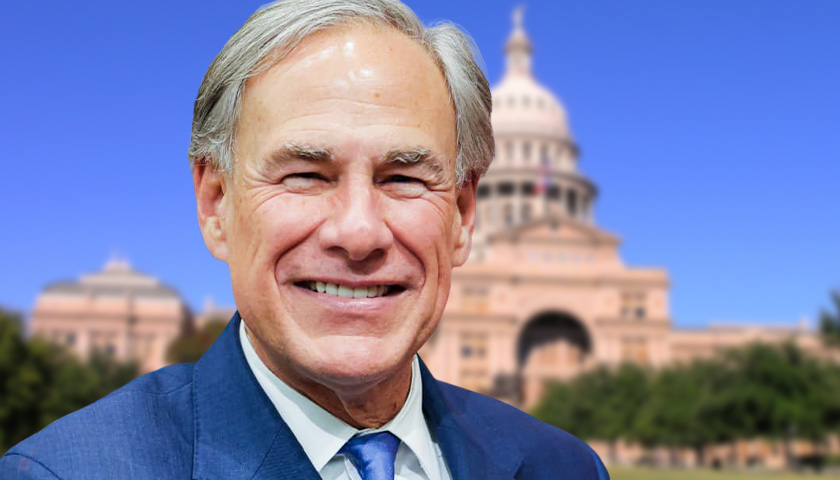

Gov. Greg Abbott says his goal is to eliminate homeowners’ property taxes in the state of Texas. He says it’s possible to achieve over time because of the significant economic growth of the state.

All three Republican leaders, Abbott, Lt. Governor Dan Patrick and Speaker Dade Phelan, have pledged to reduce property taxes and made it a legislative priority.

Read More