Moody’s Investor Services has upgraded Ohio’s credit issuer rating to “Aaa” from “Aa1” and revised the state’s financial outlook from “stable” to “positive.”

Read MoreTag: finances

Timken Endorsers Silent on Her Alleged Mismanagement of Ohio Republican Party Funds

Three U.S. Senators who this week endorsed Ohio Republican candidate Jane Timken for U.S. Senate are silent after The Ohio Star reached out to ask about Timken’s alleged mismanagement of Ohio Republican Party (ORP) funds.

Tuesday, Senators Joni Ernst (R-IA), Shelley Moore Capito (R-WV) and Deb Fischer (R-NE) endorsed Timken in the hotly contested primary race that includes candidates J.D. Vance, Mike Gibbons and Josh Mandel.

Read MoreCommentary: $800 Billion Stimulus Program Failed Terribly and Mostly Benefited the Wealthy, MIT Economist Finds

The federal government has spent an astounding $42,000 per federal taxpayer on so-called “stimulus” efforts since the pandemic began. Where did all that money go? Well, as it turns out, one of the biggest stimulus programs, the Paycheck Protection Program, failed miserably.

At least, that’s the finding of a new study from MIT economist David Autor and nine coauthors. They examined the $800 billion Paycheck Protection Program, which gave “loans,” most of which won’t have to be paid back, to businesses. It was created by Republicans and Democrats in Congress alike in hopes of helping businesses preserve their employees’ jobs for the duration of the COVID-19 crisis.

The study tracks the money to see where it ended up and what it achieved. The results… aren’t pretty.

Read MoreCommentary: Illegal Immigrants Would Get $10.5 Billion From Reconciliation Bill

The budget reconciliation package pushed by Democrats creates a new expanded child tax credit (CTC) that would pay illegal immigrants some $10.5 billion next year. All immigrants with children are eligible, regardless of how they got here and whether their children are U.S.-born. This includes the roughly 600,000 unaccompanied minors and persons in family units stopped at the border in FY2021 and released into the country pending a hearing. Cash welfare to illegal immigrants is not just costly; it also encourages more illegal immigration.

Although it is referred to as a “refundable credit,” the new CTC, like the old additional child tax credit (ACTC) it replaces, pays cash to low-income families who do not pay any federal income tax. The new program significantly increases the maximum cash payment from $1,400 per child to $3,600 for children under 6, and to $3,000 for children ages 6 to 17. After 2022, the maximum payment would be $2,000 per child, but advocates hope the much larger payments will be extended.

In an analysis conducted in October, my colleague Karen Zeigler and I estimated that illegal immigrants with U.S.-born children would receive $8.2 billion from the new CTC. However, we had assumed that the new program, like the old ACTC, would require children claimed as dependents to have Social Security numbers (SSNs). But reconciliation (page 1452, line 14) would permanently repeal this requirement.

Read MoreCommentary: I Am Challenging the Vaccine Mandate to Protect My Workers’ Jobs

The Biden administration has finally published its anticipated ultimatum threatening companies like mine with severe fines and penalties for not firing any employee who declines to be vaccinated against or submit to invasive weekly testing for COVID-19. The new rule promulgated by the U.S. Labor Department’s Occupational Safety and Health Administration (OSHA) under the guise of workplace safety may well bankrupt the business my father founded. So, as the CEO of the Phillips Manufacturing & Tower Company, I am joining with The Buckeye Institute to challenge OSHA’s vaccine mandate in court. Here’s why.

Phillips is a 54-year-old company based in Shelby, Ohio, that manufactures specialty welded steel tubing for automotive, appliance, and construction industries. OSHA’s emergency rule applies to companies with 100 or more employees — at our Shelby Welded Tube facility, we employ 104 people. As a family-owned business I take the health of my workers seriously — they are my neighbors and my friends. When I heard of the mandate, we conducted a survey of our workers to see what the impacts would be. It revealed that 28 Phillips employees are fully vaccinated, while antibody testing conducted at company expense found that another 16 employees have tested positive for COVID-19 antibodies and likely possess natural immunity. At least 47 employees have indicated that they have not and will not be vaccinated. Seventeen of those 47 unvaccinated workers said that they would quit or be fired before complying with the vaccine or testing mandate. Those are 17 skilled workers that Phillips cannot afford to lose.

Perhaps the Biden administration remains unaware of the labor shortage currently plaguing the U.S. labor market generally and industrial manufacturing especially. Like many companies, Phillips is already understaffed, with seven job openings we have been unable to fill. Employees already work overtime to keep pace with customer demand, working 10-hour shifts, six days a week on average. Firing 17 veteran members of the Phillips team certainly won’t help.

Read MoreExpect Inflation, Supply Shortages to Last Well into 2022, Economists Say

High inflation will last well into 2022, economists say, indicating that supply chain bottlenecks will keep increasing prices and curbing production.

Experts expect to see average inflation of 5.25% in December, slightly down from the current maximum predicted 5.4% figure, according to The Wall Street Journal. If inflation stays around its current level, Americans will experience the longest period during which inflation has stayed above 5% since 1991.

“It’s a perfect storm: supply-chain bottlenecks, tight labor markets, ultra-easy monetary and fiscal policies,” Michael Moran, Daiwa Capital Markets America’s chief economist, told the WSJ.

Read MoreRoughly 40 Percent of Americans Say They Recently Suffered Financial Difficulties, Study Shows

Over 40% of U.S. households said they experienced severe financial hardship during the COVID-19 pandemic, citing difficulties paying bills, credit cards and draining their savings, according to a Harvard University report.

The survey conducted by the Harvard T.H.Chan School of Health, the Robert Wood Johnson Foundation, and the National Public Radio asked roughly 3,600 participants between July and August about problems they faced during the pandemic and how it affected their lives in recent months. Respondents were asked about financial, healthcare, education and personal safety concerns.

Roughly 30% of adults interviewed said they used up all or most of their savings during the pandemic, while 10% reported they had no savings before the pandemic began, according to the report. About one in five households had difficulties paying credit cards, loans, and other debts as well as utilities.

Read MoreSome Credit Unions Already Losing Accounts over Democrats’ Plan to Expand IRS Tracking

Organizations representing community banks and credit unions are blasting the Democrats’ commitment to expanding IRS reporting requirements, calling the proposal a government overreach that would require financial institutions to spend more money on compliance costs at the expense of products and services for their members.

According to the National Association of Federally-Insured Credit Unions, customers at some credit unions have already decided to close their accounts over “government intrusion” concerns fueled by the prospect of such new rules taking effect.

The Democrats’ proposal would require financial institutions to report account activity above $600 to the IRS.

Read MoreTwo Corporate Executive Parents Found Guilty in First College Admissions Scandal Trial

Two corporate executive parents whose children attend prestigious universities were found guilty in federal court Friday for bribing university staff to rig the admissions process, The Wall Street Journal reported.

Gamal Abdelaziz, former chief operations officer of Wynn Resorts Development and John Wilson, a private-equity financier and former chief financial officer of Staples, who were tried together in federal court, each spent hundreds of thousands of dollars to falsify their childrens’ academic and athletic records to gain admission to the University of Southern California (USC), Stanford and Harvard as athletic recruits with the help of scandal ringleader and admissions consultant Rick Singer.

The two men were found guilty of conspiracy to commit fraud and conspiracy to commit bribery involving a school that receives federal funds, the WSJ reported. The jury also found Wilson guilty of aiding and abetting in fraud and bribery and filing a false tax return.

Read MoreCommentary: Real Estate Scams Are on the Rise as the Housing Market Remains Hot

When Jeff, a retired marketing consultant from Chicago, was closing on his home sale, he received a new set of instructions at the last minute on where to send several thousand dollars in closing expenses. At first blush, the email looked legit with an official-looking logo and professional language specifying the amount owed and itemized expenses. But one thing caught his eye: The email address looked strange. Just to be safe, he called his mortgage broker.

“Don’t do that!” his broker told him in an alarmed voice. It was a scam. If he hit “send,” his closing fees would go to a thief who had been monitoring his emails. “I was a keystroke away from losing thousands of dollars,” Jeff recalled.

As the housing market sizzles across the country – with nearly 6 million homes bought last year – scammers have been finding new ways to tap into this once-secure market. Real estate transactions still demand reams of paperwork and regulations involving lawyers, brokers, title insurance companies and banks, but the fact that much of this work now takes place online gives thieves countless opportunities to exploit vulnerable buyers. Last year, more than 11,000 homeowners were scammed out of more than $220 million in closing funds alone, according to the American Land and Title Association, a trade group that represents professionals who perform property transactions.

Read MoreRepublican Lawmakers Say China’s Cryptocurrency Crackdown Is an Opportunity for America

Republican lawmakers say China’s recent crackdown on financial technologies could offer an opportunity for the U.S. to press its advantage in innovation.

China’s central bank issued a statement Friday morning declaring all cryptocurrency transactions and services illegal, banning coin mining operations and vowing to crack down on its citizens’ use of foreign crypto exchanges.

Several Republicans say China’s loss could be the United States’ gain.

Read MoreBig Tech, Woke Finance Crack Down on Flynn, Gateway Pundit, Berenson in Cancel Culture Purge

With national attention riveted over the weekend on two major stories — the frantic U.S. withdrawal from Afghanistan amid its fall to the Taliban and category 4 Hurricane Ida slamming into the Louisiana coast — Big Tech and woke finance dramatically extended the reach of cancel culture with brazen moves to silence and harass three high-profile voices of political and scientific dissent: independent journalist Alex Berenson, popular conservative news and opinion website The Gateway Pundit, and Lt. Gen. Michael Flynn.

On Saturday, Twitter permanently banned Alex Berenson, who has built a large social media following challenging public health establishment orthodoxy on COVID issues ranging from lockdown to vaccine mandates.

“The account you referenced has been permanently suspended for repeated violations of our COVID-19 misinformation rules,” a Twitter spokesperson responded to an inquiry from Fox News.

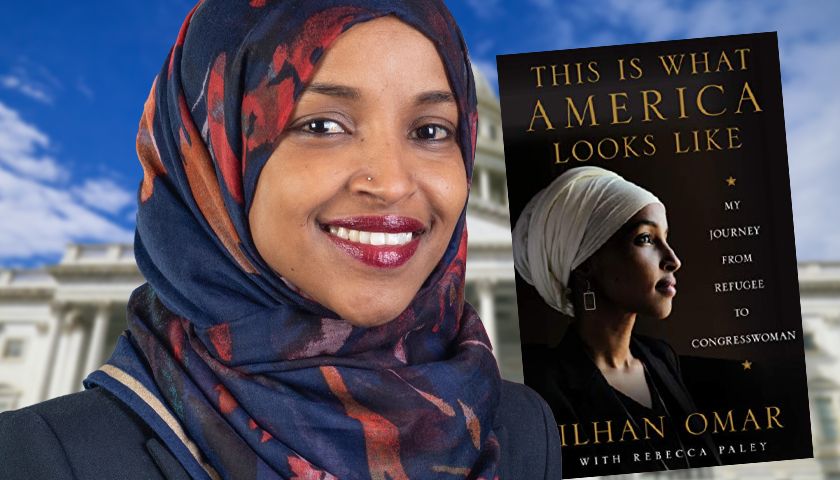

Read MoreWatchdogs Sound Alarm as Ilhan Omar Continues to Evade Financial Disclosure of Reportedly Lucrative Book Deal

Multiple watchdog groups said Minnesota Rep. Ilhan Omar may have violated federal law for failing to mention any income received from her critically-acclaimed 2020 memoir in her latest financial disclosure report filed on Friday.

Omar reportedly signed a deal worth up to $250,000 for her memoir, “This Is What America Looks Like,” in January 2019, around the same time she was sworn into Congress. Omar’s communications director said the House Ethics committee approved the book deal, but the Democratic lawmaker’s financial disclosures covering the calendar years 2018 and 2019 contain no mention of the book or any advance income received upon signing a deal.

The book was published in May 2020 to rave reviews by the press and Omar’s Democratic colleagues. The Atlantic dubbed it one of the best political books of the year, and numerous high profile Democrats, including House Speaker Nancy Pelosi, Rep. Alexandria Ocasio-Cortez of New York and Rep. Ayanna Pressley of Massachusetts, praised on the book.

Read MoreIRS: California Shrank by 165K Taxpayers, $8.8 Billion in Gross Income

California residents of all ages and incomes are leaving for more tax friendly climates, and they’re taking billions of dollars in annual income with them.

The Internal Revenue Service recently released its latest taxpayer migration figures from tax years 2018 and 2019. They reflect migratory taxpayers who had filed in a different state or county between 2017 and 2018, of which 8 million did in that timespan.

California, the nation’s most-populous state, lost more tax filers and dependents on net than any other state.

Read MoreCommentary: New York and New Jersey Are Among the Top 10 States Where Residents Pay the Highest Lifetime Taxes

In the mood for a depressing statistic? A new report from the financial services firm Self concludes that the average American will pay an astounding $525,037 in taxes over their lifetime—roughly 34 percent of their lifetime earnings.

But the numbers aren’t uniform across the country; they vary wildly from state to state. Based on taxes on earnings, spending, property, and cars, here are the 10 states where residents pay the highest taxes over a lifetime.

1. New Jersey

Topping the list is New Jersey, where residents will, on average, owe an astounding $932,000 in taxes over their lifetime. That’s nearly 50 percent of their typical lifetime earnings!

Read MoreCommentary: Debt Is the Most Predictable Crisis in U.S. History

Former Treasury Secretary Henry Paulson issued a stern warning in last week’s Wall Street Journal: “A world-class financial system can’t exist in a country that fails to maintain the quality of its credit.”

America’s debt problem was already wildly out of control for the past 20 years, but we now face truly unprecedented additional levels of debt issued by Congress in response to the pandemic. From 2000 to 2019, the federal debt rose from $5.6 trillion to $22.7 trillion, and it is expected to top $27 trillion by year’s end, a whopping 19 percent increase this year. Another trillion in virus relief spending now seems to be at the low end of spending estimates going into 2021.

Read MoreSurvey: Families in Four Largest U.S. Cities Facing Significant Financial, Health, Education Setbacks

More than half of the households surveyed in the four largest U.S. cities are facing serious financial problems as a result of their state and city shutdowns, a new five-part polling series conducted by NPR, The Robert Wood Johnson Foundation, and Harvard T.H. Chan School of Public Health, found.

Read MorePoll: Over Three-Quarters of Americans Say Their Finances Are Stable or Getting Better

A majority of registered voters report that their personal finances are stable or improving, according to a new Just the News Daily Poll with Scott Rasmussen.

Asked about their current financial situation, amid a pandemic and street protests that shuttered some retail businesses, 52% of respondents said their bank account is “about the same” as it normally is, while 23% said their personal finances are “getting better.” Just 23% reported a worsening financial outlook.

Read More